The vast majority of marketers cut their ad budgets during a recession because they believe the savings will outweigh any positive impact their campaigns will have. (Most estimates suggest advertising investment is likely to be reduced by between 30% and 60% over the rest of 2020 and beyond. Marketing Week’s latest survey suggests that around 90% of marketing budgets have been delayed or are under review.

Truth is, cutting back on your advertising is one of the worst moves you can make. The evidence is overwhelming. History, advertising research and the latest economic forecasts from Goldman Sachs are all saying the same thing:

“Now is the time to invest more (not less) into long-term brand building advertising.”

I know. I know. That’s exactly what you’d expect to hear from someone who owns an ad agency. And that’s exactly why I’ve loaded today’s article with evidence from Mark Ritson, WARC, IPA, Kantar, The Strategic Planning Institute, Les Binet and Peter Field, Data2Decisions and Millward Brown, Nielsen and others that should turn any skeptic into a believer.

OVER A CENTURY OF EMPIRICAL STUDIES CONFIRM THAT INCREASING AD SPEND DURING A RECESSION INCREASES LONG-TERM MARKET SHARE GAINS

Alex Biel and Stephen King of the Strategic Planning Institute analyzed the performance of 390 firms listed on the PIMS (Profit Impact of Marketing Strategy) database during historical recessionary periods. They divided their results into companies that decreased ad spend, increased it by less than 20% or increased it by more than 20%.

They found that companies that cut their ad budgets did not lose share during recessions because they picked up a little bit of market share from companies going out of business or leaving the market. Just staying in business during a recession reaped a small increase in market share of 0.2% on average. However, these companies did not see any increase in profitability from cutting back on their advertising either. The conclusion: “Cutting back on advertising during recessions doesn’t seem to work.”

The companies that increased ad spend during a recession realized significant increases in market share from their increased budgets.

Companies increasing ad spend by up to 20% saw an average share gain of 0.5% and those that increased beyond the 20% threshold recorded average gains of 0.9%.

King and Biel found that most of the market share gains were achieved during the recessionary period. What’s more those companies that gained market share tended to maintain that share and grow profits in the long run after the recession. However, the opportunity to gain market quickly dissipated once the recession ended.

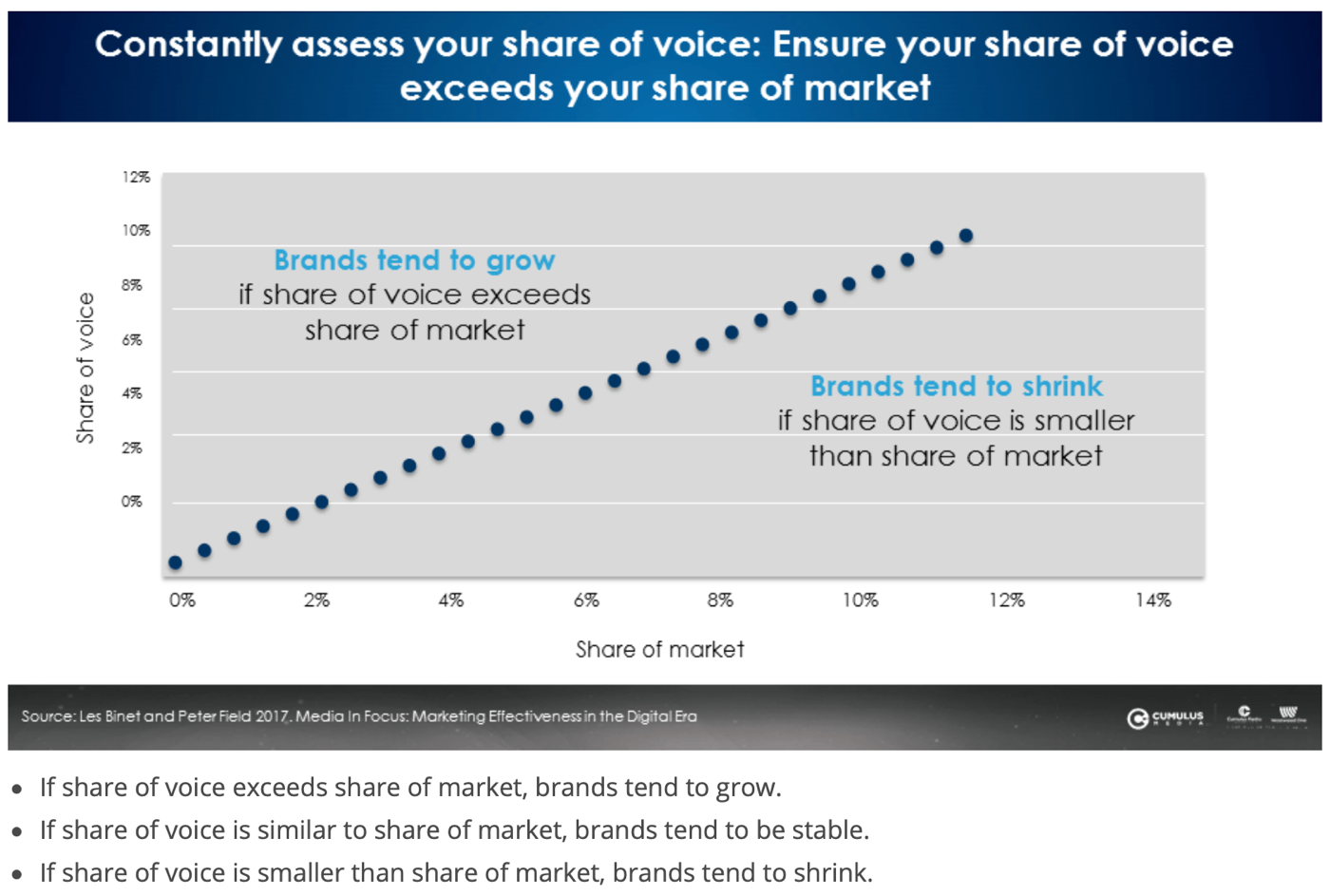

ADVERTISING IS MORE EFFECTIVE THAN NORMAL DURING A RECESSION

Recessions present a rare opportunity for companies to gain market share. The reason is simple. As more companies decrease their advertising or go dark, those that maintain or increase their advertising have less competition for attention. With less competition, it’s easier to cut through, connect with and make a positive, long-term impression. We know this from studies conducted by Les Binet and Peter Field on how Share Of Voice (SOV) correlates with Share Of Market (SOM) and impacts growth. SOV is calculated as the brand ad spend divided by the category ad spend. SOM is a brand’s revenue divided by category sales. When a brand SOV exceeds its SOM, it tends to grow.

As I mentioned above, 90% of marketing budgets are on hold or under review. Which means there’s a very good chance your rivals have cut or suspended their advertising. So, don’t just sit there. Turn up your advertising and increase your Share Of Voice now. In essence, you’ll be buying market share at an extreme discount.

ADVERTISING IS LESS EFFECTIVE THAN NORMAL AFTER A RECESSION

Once a recession ends, it’s much more expensive and difficult to make big gains in SOV and SOM. Studies show that right after a recession, everyone jumps back into advertising. More noise and more competition for attention means you are less likely to make the same gains you can during a recession for the same spend. In other words, it is more challenging and expensive to regain market share after going dark during a recession.

Finally, Gerard and Kethan Tellis reviewed 40 different studies and papers on advertising and recessions across 37 different countries. Here is a summary of their key conclusion:

“…most firms tend to cut back on advertising during a recession. This behavior reduces noise and increases the effectiveness of advertising of any single firm that advertises. Thus, the firm that increases advertising in this environment can enjoy higher sales and market share. When the economy expands, all firms tend to increase advertising. At that point, no single firm gains much by that increase. The gains of the firms that maintained or increased advertising during a recession, however, persist. This theory is also the most reasonable explanation for all the empirical effects of GDP on advertising and of advertising on sales, market share and profitability. It is also a simple, but strong, refutation of the theory for cutting back on advertising during a recession.”

Read Research on Advertising in a Recession: A Critical Review and Synthesis by Gerard and Kethan Tellis

CUTTING ADVERTISING CAN LENGTHEN THE TIME IT TAKES FOR COMPANIES TO RECOVER FINANCIALLY

A study of the 2007-2009 recession using data gathered from 200 brands found that brands who eliminated ad spending took nearly 5 years to recover while brands who maintained or increased ad spend rebounded much faster and, in some cases, grew their revenue.

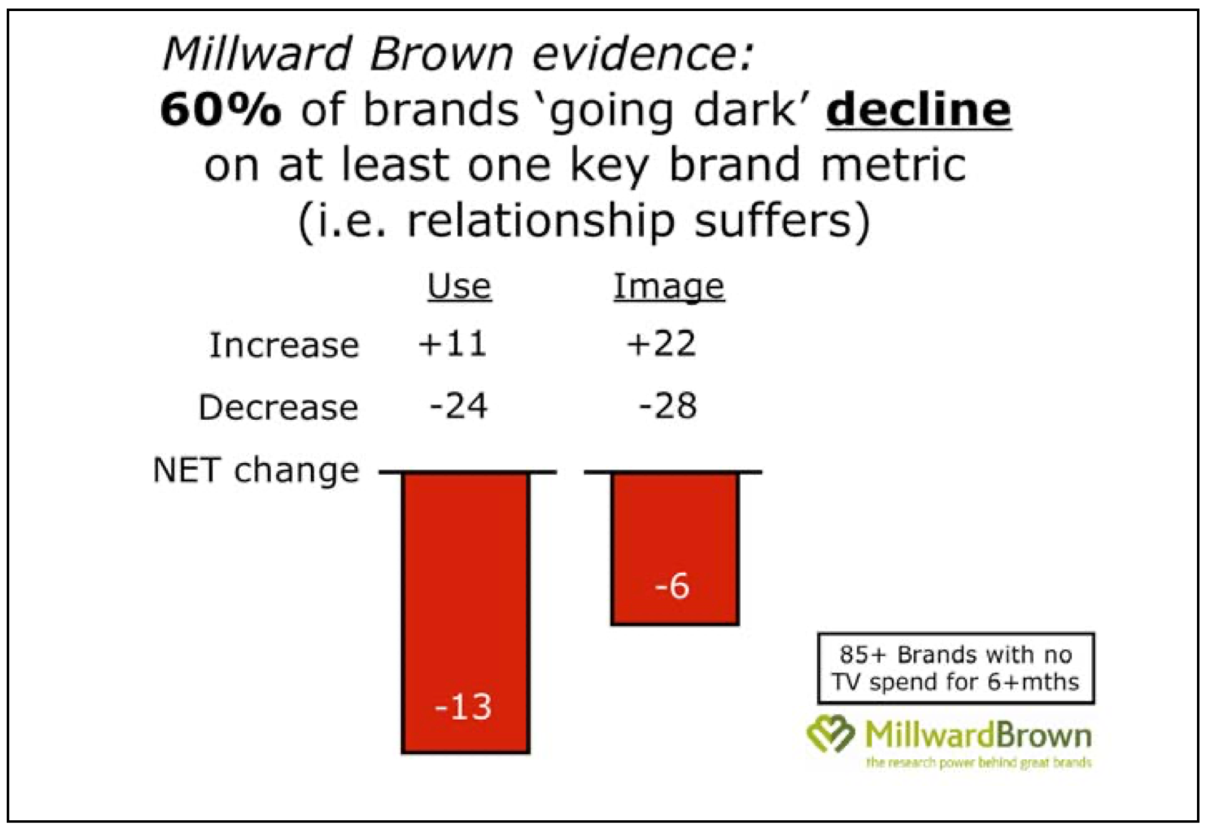

BRAND IMAGE AND BRAND USAGE DECLINE PRECIPITOUSLY WHEN ADVERTISING GOES “DARK”

If it’s important to you that people use (buy) your brand and have a positive perception of it then for heaven’s sake DO NOT STOP ADVERTISING. Enough said.

STRONG BRANDS RECOVER FROM A RECESSION 9X FASTER THAN THE S&P 500

When the recession ends, strong brands will recover quicker than weak ones. A study by Kantar and BrandZ compared the stock market performance of strong brands in their list of the Top 100 Most Valuable Global Brands to the performance of the S&P 500. While all companies were negatively impacted by The Great Recession in 2008, the ones with strong brands recovered much quicker and have grown much faster than the S&P 500.

Emphasizing short-term sales, often through promotions, in order to satisfy profit targets can have negative brand equity repercussions. To maximize advertising effectiveness brands should invest at least 60% of their advertising into long-term brand building and no more than 40% into short-term sales activation promotions. During a recession, when people have less money to buy, you should invest significantly more of your budget into long-term brand building. Because short-term, promotional marketing does not change brand perception, money is better spent during a recession on long-term brand building. Doing so will “prime the pump” for demand once the recession ends and people have more money to spend.

People don’t hate advertising. They hate boring, unoriginal and pushy advertising. And according to most people, the majority of ads they see are all the above. Having advertising that people actually welcome and enjoy is a huge competitive advantage. And the ads that people welcome and enjoy are creative ones.

Research has unequivocally proven, people pay more attention to creative ads, recall them better and talk about them more. Clients who utilize them spend less on media and sell more. According to research conducted by Peter Field for the Institute of Practitioners in Advertising (IPA), creative ads are 11 times more efficient at selling stuff than other ads. What’s more, consumers have more positive feelings about companies and their products that utilize more creative advertising.

In fact, according to a recent study by Nielson and Nielson Catalina Solutions creativity beats reach and targeting in driving sales, accounting for 47% of an ad’s impact. The same study also found that creativity outperforms media channel which only contributes 30% to lifting sales.

And if that’s not enough proof, James Hurman concludes in the The Case For Creativity that creatively awarded campaigns deliver 11x the ROI than non-awarded ones.

Increase your reach. Despite what you’ve heard, targeting that’s too tightly defined can actually stunt growth. Here’s why. For most companies, 50% of growth comes from new and infrequent purchasers. This is in direct conflict with Pareto’s law which states 80% of sales come from 20% of current customers. In How Brands Grow, Byron Sharp presents data that proves growth is directly correlated with increasing the reach of your advertising and penetration of your product. To maximize growth, you should concentrate your marketing efforts on acquiring new customers – not retaining old ones. To do this, your advertising should reach every buyer in the market for your product or service your budget will allow.

PROCTOR & GAMBLE IS INCREASING MARKETING SPEND

Despite the word “Gamble” being in their name, P&G’s approach to advertising is anything but risky. Over the last 100 years it’s earned the title as the world’s best marketing company by successfully launching and growing hundreds of famous brands. Through smart strategies, media buys and memorable creative, it’s earned the title as the world’s best marketing company. Over the last hundred years it’s literally launched and grown hundreds of famous brands around the world.

During recessions and times of uncertainty, P&G has increased their marketing. During the global pandemic is no exception. Marketing Dive reports that CFO Jon Moeller said P&G is “doubling down” while other companies are cutting back their media spend. "There's big upside here in terms of reminding consumers of the benefits that they've experienced on our brands and how they've served their families' needs, which is why this is not a time to go off air," Moeller said in a discussion about the company's marketing. P&G, whose brands include Charmin, Bounty, Tide and Olay, increased marketing spending more than $320 million in the quarter, or by 1.9 percentage points as a share of sales.

So, there you have it. The smart money is investing more in advertising now – not less. While there are no guarantees, upping your ad spend in a recession is about as close to a sure thing in marketing as you’ll ever get. Ready to gain some market share? We can help ensure your messaging and media buy deliver the highest returns possible.

Eternally Yours:

David Smith | Founder & Creative Leader